Exhibit 99.1

Investor Presentation NASDAQ: RMCF • November 2025 A Transformation in Progress

Safe Harbor Statement This presentation is for informational purposes only and is not an offer to sell securities or a solicitation of an offer to buy any securities and may not be relied upon in connection with the purchase or sale of any security. Sales and offers to sell Rocky Mountain Chocolate Factory, Inc. (the “Company”) securities will only be made in accordance with the rules and regulations of the Securities and Exchange Commission (SEC), including the Securities Act of 1933, as amended, or an exemption from registration. This presentation is proprietary and is intended solely for the information of the persons to whom it is presented and may not be retained, reproduced, or distributed, in whole or in part, by any means (including electronic) without the prior written consent of the Company. This presentation includes statements of our expectations, intentions, plans, and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements involve various risks and uncertainties. The statements, other than statements of historical fact, included in this press release are forward-looking statements. Many of the forward-looking statements contained in this document may be identified by the use of forward-looking words such as "will," "intend," "believe," "expect," "anticipate," "should," "plan," "estimate," "potential," “may,” “would,” “could,” “continue,” “likely,” “might,” “seek,” “outlook,” “explore,” or the negative of these terms or other similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future, including statements regarding future financial and operating results, our business strategy and plan, our strategic priorities, our market opportunities, our store pipeline, and our transformation, are forward-looking statements. Management of the Company believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date of this press release. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause the Company’s actual results to differ materially from historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to: inflationary impacts, the outcome of legal proceedings, changes in the confectionery business environment, seasonality, consumer interest in our products, receptiveness of our products internationally, consumer and retail trends, costs and availability of raw materials, competition, the success of our co-branding strategy, the success of international expansion efforts, financial covenants in our credit agreements, and the effect of government regulations. For a detailed discussion of the risks and uncertainties that may cause our actual results to differ from the forward-looking statements contained herein, please see the section entitled “Risk Factors” contained in our periodic reports, each filed with the Securities and Exchange Commission. This presentation contains statistical data that we obtained from industry publications and reports generated by third parties. Although industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable, we have not independently verified this statistical data.

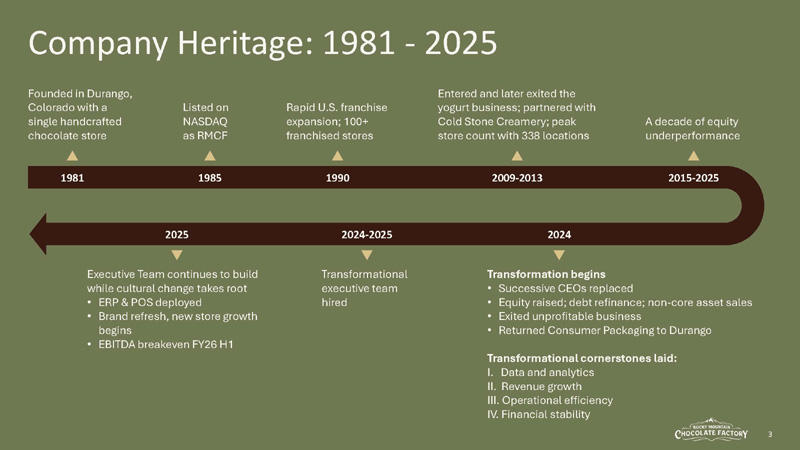

Company Heritage: 1981 - 2025 Founded in Durango, Colorado with a single handcrafted chocolate store 1981 Listed on NASDAQ as RMCF 1985 Rapid U.S. franchise expansion; 100+ franchised stores 1990 Entered and later exited the yogurt business; partnered with Cold Stone Creamery; peak store count with 338 locations 2009-2013 A decade of equity underperformance 2015-2025 2025 Executive Team continues to build while cultural change takes root • ERP & POS deployed • Brand refresh, new store growth begins • EBITDA breakeven FY26 H1 2024-2025 Transformational executive team hired 2024 Transformation begins • Successive CEOs replaced • Equity raised; debt refinance; non-core asset sales • Exited unprofitable business • Returned Consumer Packaging to Durango Transformational cornerstones laid: I. Data and analytics II. Revenue growth III. Operational efficiency IV. Financial stability

Failure to Deliver – 10 Years Store Count Oct-2015 to Oct-2025 Franchisee Company Owned Licensee Total 2025 139 3 112 254 2020* 218 2 107 327 2015* 272 3 72 365 * Includes 52 (2020) and 62 (2015) in Canada

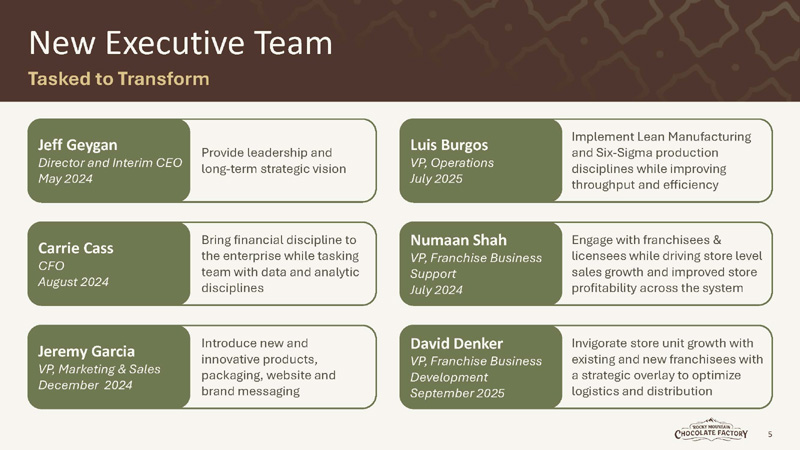

New Executive Team Tasked to Transform Jeff Geygan Director and Interim CEO May 2024 Provide leadership and long-term strategic vision Luis Burgos VP, Operations July 2025 Implement Lean Manufacturing and Six-Sigma production disciplines while improving throughput and efficiency Carrie Cass CFO August 2024 Bring financial discipline to the enterprise while tasking team with data and analytic disciplines Numaan Shah VP, Franchise Business Support July 2024 Engage with franchisees & licensees while driving store level sales growth and improved store profitability across the system Jeremy Garcia VP, Marketing & Sales December 2024 Introduce new and innovative products, packaging, website and brand messaging David Denker VP, Franchise Business Development September 2025 Invigorate store unit growth with existing and new franchisees with a strategic overlay to optimize logistics and distribution

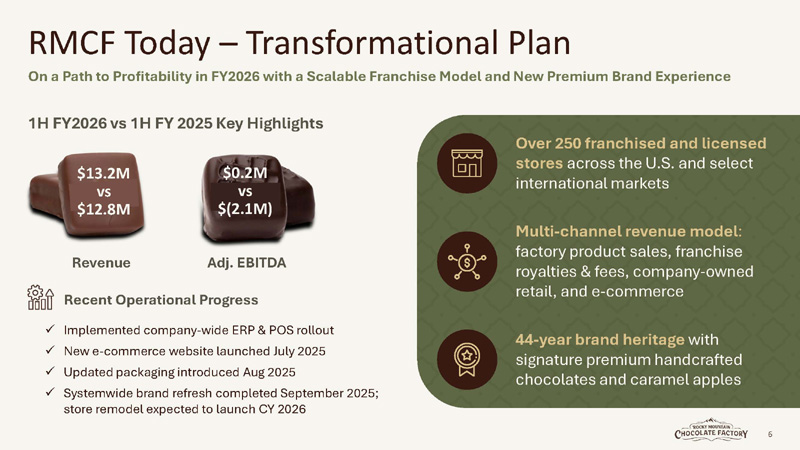

RMCF Today – Transformational Plan On a Path to Profitability in FY2026 with a Scalable Franchise Model and New Premium Brand Experience 1H FY2026 vs 1H FY 2025 Key Highlights $13.2M vs $12.8M $0.2M vs $(2.1M) Revenue Adj. EBITDA Recent Operational Progress Implemented company-wide ERP & POS rollout New e-commerce website launched July 2025 Updated packaging introduced Aug 2025 Systemwide brand refresh completed September 2025; store remodel expected to launch CY 2026 Over 250 franchised and licensed stores across the U.S. and select international markets Multi-channel revenue model: factory product sales, franchise royalties & fees, company-owned retail, and e-commerce 44-year brand heritage with signature premium handcrafted chocolates and caramel apples

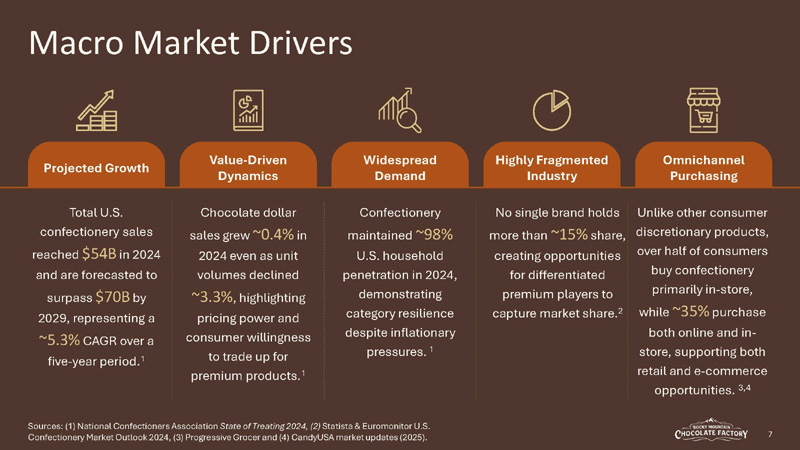

Macro Market Drivers Projected Growth Total U.S. confectionery sales reached $54B in 2024 and are forecasted to surpass $70B by 2029, representing a ~5.3% CAGR over a five-year period.1 Chocolate dollar sales grew ~0.4% in 2024 even as unit volumes declined ~3.3%, highlighting pricing power and consumer willingness to trade up for premium products.1 Confectionery maintained ~98% U.S. household penetration in 2024, demonstrating category resilience despite inflationary pressures. 1 No single brand holds more than ~15% share, creating opportunities for differentiated premium players to capture market share.2 Unlike other consumer discretionary products, over half of consumers buy confectionery primarily in-store, while ~35% purchase both online and in-store, supporting both retail and e-commerce opportunities. 3,4 Sources: (1) National Confectioners Association State of Treating 2024, (2) Statista & Euromonitor U.S. Confectionery Market Outlook 2024, (3) Progressive Grocer and (4) CandyUSA market updates (2025).

Company Drivers Niche Positioning Includes RMCF premium handcrafted product sales and in-store made items Customer Experience Store experience where caramel apples are freshly created and batch fudge is produced on stone slab tables Widespread Demand Demand in high-traffic areas with successful operators in airport, resort, high-end fashion retail and casino venues Sensual Immersion Store atmosphere that engages all five senses and introduces an immersive chocolate experience Modernized Store Design New store features a modern, open layout with warm wood accents, an expanded ice cream counter, and our signature mountain-sized chocolates

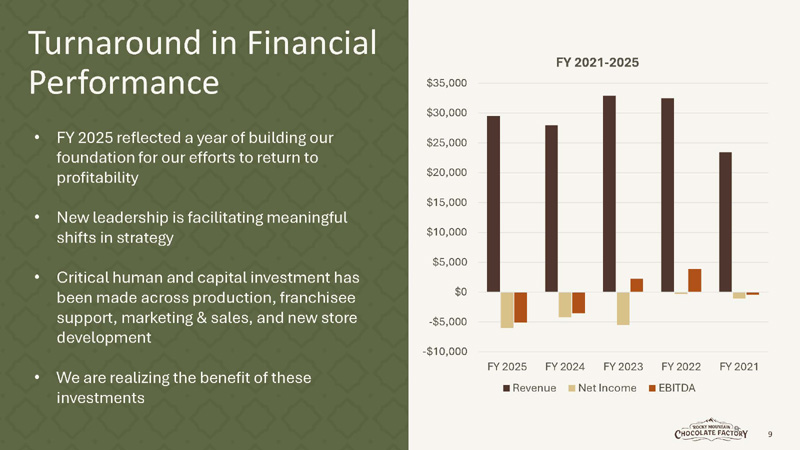

Turnaround in Financial Performance FY 2025 reflected a year of building our foundation for our efforts to return to profitability New leadership is facilitating meaningful shifts in strategy Critical human and capital investment has been made across production, franchisee support, marketing & sales, and new store development We are realizing the benefit of these investments FY 2021-2025

Long-Term Strategic Transformation Plan

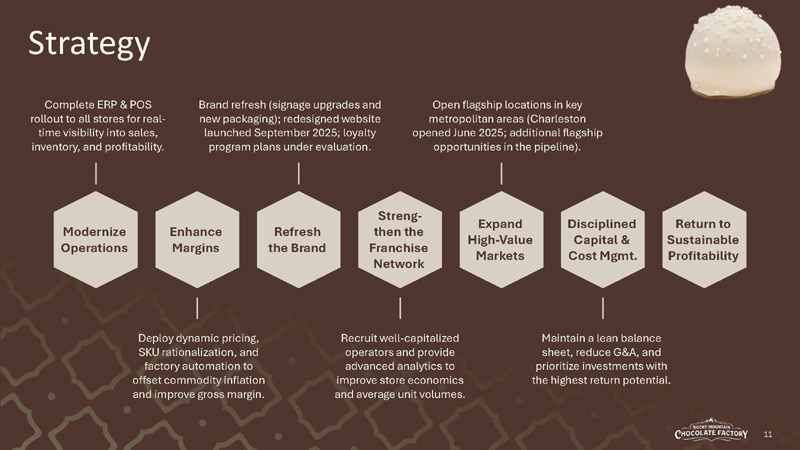

Strategy Modernize Operations Complete ERP & POS rollout to all stores for real-time visibility into sales, inventory, and profitability. Enhance Margins Deploy dynamic pricing, SKU rationalization, and factory automation to offset commodity inflation and improve gross margin. Refresh the Brand Brand refresh (signage upgrades and new packaging); redesigned website launched September 2025; loyalty program plans under evaluation. Streng-then the Franchise Network Recruit well-capitalized operators and provide advanced analytics to improve store economics and average unit volumes. Expand High-Value Markets Open flagship locations in key metropolitan areas (Charleston opened June 2025; additional flagship opportunities in the pipeline). Disciplined Capital & Cost Mgmt. Maintain a lean balance sheet, reduce G&A, and prioritize investments with the highest return potential. Return to Sustainable Profitability

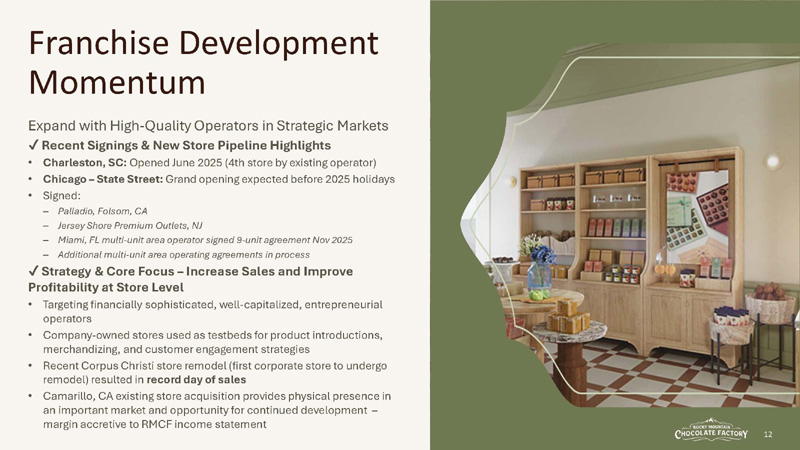

Franchise Development Momentum Expand with High-Quality Operators in Strategic Markets ✔ Recent Signings & New Store Pipeline Highlights C: Opened June 2025 (4th store by existing operator) Chicago – State Street: Grand opening expected before 2025 holidays Signed: Palladio, Folsom, CA Jersey Shore Premium Outlets, NJ Miami, FL multi-unit area operator signed 9-unit agreement Nov 2025 Additional multi-unit area operating agreements in process ✔ Strategy & Core Focus – Increase Sales and Improve Profitability at Store Level Targeting financially sophisticated, well-capitalized, entrepreneurial operators Company-owned stores used as testbeds for product introductions, merchandizing, and customer engagement strategies Recent Corpus Christi store remodel (first corporate store to undergo remodel) resulted in record day of sales Camarillo, CA existing store acquisition provides physical presence in an important market and opportunity for continued development – margin accretive to RMCF income statement

Operational Upgrades Modernizing the Platform to Drive Efficiency and Visibility ERP & POS Rollout Complete Connected 115+ stores with real-time sales data, product mix and store level margin visibility – continued enforcement of common POS across all locations Store websites featuring BUY NOW Store level fulfillment for 3rd Party Delivery – improving profitability while driving average ticket value; increased SEO and Social Media results 3rd Party Delivery Corporate working with all major 3PD to negotiated favorable rates and encouraged store adoption Consumer Packaging Operations Brought In-House Shift eliminated roughly $1.5M in yearly losses and improved quality control and shipping timeliness Flat-Fee Freight & Logistics Faster deliveries from new Albuquerque warehouse and fresher product for franchisees, while lowering cost variability Factory Throughput & Automation Early automation pilots and SKU simplification improving production efficiency with Lean Manufacturing and Six Sigma discipline resulted in scrap and waste reduction and better production statistics

Margin & Cost Actions Disciplined Cost Management and Margin Recovery Cocoa Purchasing Strategy Locked in cocoa pricing between $6,000 and $8,000/MT, a significant reduction from recent highs SKU Rationalization & Production Efficiency Focus on high-volume, profitable products; reduced waste and scrap G&A Reductions Achieved $1.5M year-over-year decline in Q1 FY2026 operating expenses; more expected to come Flat-Fee Freight Program National freight model lowering shipping variability and product freshness; improving store level sales and profitability In-House Packaging Restored Brought packaging back to Durango facility, strengthening quality control and store delivery timeliness Long-Term Goal Management expects continued gross-margin improvement as transformation initiatives continue

Rebrand & Growth New Look, New Stores: Positioning RMCF for the Next Era of Growth Flagship Launch & New Store Development First flagship with modern format opened in Charleston, SC (June 2025); multiple new store openings in the pipeline. Systemwide Brand Refresh Updated logo, in-store signage, and e-commerce platform rolling out through FY2026. Stronger Franchise Network Recruiting multi-unit operators to drive higher average unit volumes and accelerate market expansion. Expansion Pipeline Active lease negotiations in major U.S. cities for additional FY2026 openings. Enhanced Digital Presence Upcoming loyalty program and upgraded online store designed to increase omnichannel engagement.

Digital Expansion & Customer Engagement Reaching Consumers Where They Are Website Relaunch (Q2 FY26) Modern UX reflecting new branding and packaging Serves as a curated sampling experience, directing traffic to physical stores Loyalty Program Launch – Early Calendar 2026 Personalized, mobile-friendly rewards platform to launch shortly after the first of the year Aims to drive frequency and repeat purchases across locations 3rd Party Delivery POS Integration DoorDash storefront model rolling out system-wide Negotiating with DoorDash, Uber Eats, Grub Hub, Instacart and ezCater systemwide Improved unit economics and broader market reach Foundation set for expansion to additional platforms

Investment Highlights Differentiated Brand with a Path to Growth and Profitability Diversified, Scalable Revenue Model Factory product sales, recurring revenue (royalties), franchise royalties & fees, company-owned retail, and e-commerce provide multiple growth levers Motivated and Aligned Leadership New executive management team with food, franchising, production, sales, marketing and financial expertise to return RMCF to consistent, long-term growth and profitability supported by a refreshed board of directors Strong Franchise Momentum Growing franchise interest and pipeline; targeting well-capitalized multi-unit operators. Currently the strongest franchisee pipeline in many years Large, Growing Addressable Market Positioned within the fragmented U.S. chocolate and candy shop segment, supported by ongoing category consumption growth with additional opportunity north and south of the border

Appendix

Board of Directors Mel Keating Director and Board Chair Steven L. Craig Director Jeff Geygan Director and Interim CEO Brian Quinn Director

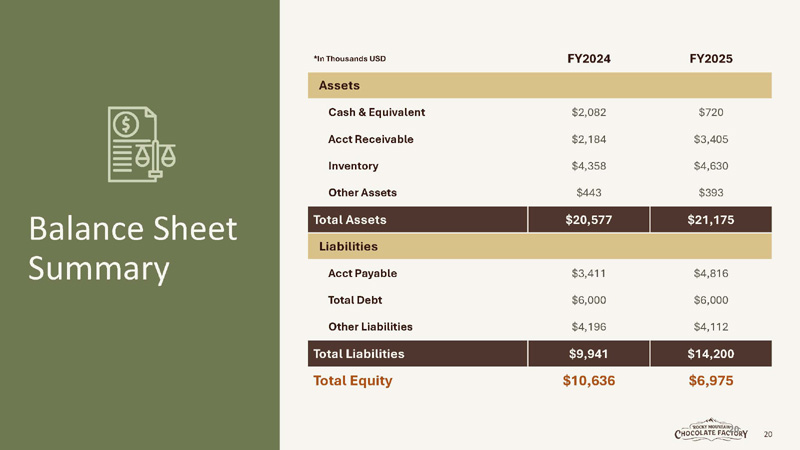

Balance Sheet Summary *In Thousands USD FY2024 FY2025 Assets Cash & Equivalent $2,082 $720 Acct Receivable $2,184 $3,405 Inventory $4,358 $4,630 Other Assets $443 $393 Total Assets $20,577 $21,175 Liabilities Acct Payable $3,411 $4,816 Total Debt $6,000 $6,000 Other Liabilities $4,196 $4,112 Total Liabilities $9,941 $14,200 Total Equity $10,636 $6,975

Investor Relations Contact Sean Mansouri, CFA 720-330-2829 RMCF@elevate-ir.com