UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number:

(Exact name of registrant as specified in its charter)

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices, including ZIP code)

(

(Registrant’s telephone number, including area code)

Securities Registered Pursuant To Section 12(b) Of The Act:

Title of each class |

|

Trading |

|

Name of each exchange on which registered |

|

|

The |

Securities Registered Pursuant To Section 12(g) Of The Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer |

☐ |

|

Accelerated filer |

☐ |

|

|

|

|

|

☒ |

|

Smaller reporting company |

||

|

|

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

The aggregate market value of the registrant’s common stock (based on the closing price as quoted on the Nasdaq Global Market on August 31, 2023, the last business day of the registrant’s most recently completed second fiscal quarter) held by non-affiliates was $

As of May 31, 2024, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement in connection with the 2024 Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference in Part III of this Annual Report on Form 10-K. The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended February 29, 2024.

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

FORM 10-K

TABLE OF CONTENTS

|

3 |

|

|

|

|

ITEM 1. |

3 |

|

ITEM 1.A |

14 |

|

ITEM 1.B |

24 |

|

ITEM 1.C |

24 |

|

ITEM 2. |

24 |

|

ITEM 3. |

24 |

|

ITEM 4. |

25 |

|

|

|

|

|

26 |

|

|

|

|

ITEM 5. |

26 |

|

ITEM 6. |

26 |

|

ITEM 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

27 |

ITEM 7A. |

33 |

|

ITEM 8. |

34 |

|

ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

64 |

ITEM 9A. |

64 |

|

ITEM 9B. |

64 |

|

ITEM 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

65 |

|

|

|

|

66 |

|

|

|

|

ITEM 10. |

66 |

|

ITEM 11. |

66 |

|

ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

66 |

ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence |

66 |

ITEM 14. |

66 |

|

|

|

|

|

67 |

|

|

|

|

ITEM 15. |

67 |

|

ITEM 16. |

70 |

1

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) contains statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and are intended to come within the safe harbor protection provided by those sections. All statements other than statements of historical fact are “forward-looking statements,” including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management, including for future operations, or capital expenditures; any statements concerning proposed new products, services, or developments; any statements regarding future economic conditions or performance; any statements of belief or expectation; and any statements of assumptions underlying any of the foregoing or other future events. Forward-looking statements may include, among others, words such as “will,” “may,” “would,” “could,” “might,” “likely,” “objective,” “predict,” “project,” “drive,” “seek,” “aim,” “target,” “outlook,” “continue” “intend,” “believe,” “expect,” “anticipate,” “should,” “plan,” “estimate,” “potential,” or similar expressions. Forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, or implied. Although it is not possible to predict or identify all such risks and uncertainties, they include, but are not limited to, the factors discussed in Item 1A. “Risk Factors” of Part I of this Annual Report and as described elsewhere in this Annual Report. All forward-looking statements are expressly qualified in their entirety by these and other cautionary statements that we make from time to time in our other SEC filings and public communications. You should evaluate forward-looking statements in the context of these risks and uncertainties and are cautioned not to place undue reliance on such statements. Forward-looking statements in this Annual Report are made only as of the date hereof, and we undertake no obligation to update or revise any forward-looking statement except as may be required by law.

2

PART I.

ITEM 1. BUSINESS

Our Company

Rocky Mountain Chocolate Factory, Inc., a Delaware corporation, and its subsidiaries (collectively, the “Company,” “Rocky Mountain,” “we,” “us,” or “our”), including its operating subsidiary with the same name, Rocky Mountain Chocolate Factory, Inc., a Colorado corporation (“RMCF”), is an international franchisor, confectionery producer and retail operator. Founded in 1981, we are headquartered in Durango, Colorado and produce an extensive line of premium chocolate candies and other confectionery products (“Durango Products”). Our revenues and profitability are derived principally from our franchised/licensed system of retail stores that feature chocolate and other confectionary products. We also sell our candy in select locations outside of our system of retail stores. As of February 29, 2024, we operated 2 Company-owned and had 115 licensee-owned and 152 Rocky Mountain Chocolate Factory franchised stores spread across 36 states and the Philippines.

In fiscal year (“FY”) 2024, roughly half of all retail store sales were of the products prepared on premises and the other half were of products purchased from our Durango plant. We believe that in-store product preparation creates a special store ambiance, and the aroma and sight of products being made attracts foot traffic and assures customers that products are fresh.

Our principal competitive advantage lies in our brand name recognition, and reputation for the quality, variety and taste of our products. Further, we believe the ambiance of our stores, our expertise in the production of chocolate candy products, the merchandising and marketing of confectionary products, and the control and training infrastructures we have implemented to ensure consistent customer service and execution of successful practices and techniques at our stores provides Rocky Mountain Chocolate Factory with a unique franchise offering.

We believe our production expertise and reputation for quality has facilitated the sale of select products through Specialty Markets. We are currently selling our products in a select number of Specialty Markets, including wholesale, fundraising, corporate sales, e-commerce, and private label (collectively “Specialty Markets”).

Our consolidated revenues in FY 2024 were primarily derived from three principal sources: (i) sales to franchisees and other third parties of chocolates and other confectionery products produced by us (74%-77%-76% in 2024, 2023 and 2022 respectively); (ii) sales at Company-owned stores of chocolates and other confectionery products (including products produced by us) (5%-3%-4%), and (iii) the collection of initial franchise, royalties and marketing fees from franchisees (21%-20%-20%). For FY 2024, nearly all of our revenues were derived from domestic sources, with less than 1% derived from international sources. As described below, the Company sold its frozen yogurt business subsequent to the end of FY 2023.

Sale of Frozen Yogurt Business

On May 1, 2023, subsequent to the end of FY 2023, we completed the sale of substantially all of the assets of its wholly-owned subsidiary and frozen yogurt business, U-Swirl International, Inc. (“U-Swirl”). The aggregate sale price of U-Swirl was $2.75 million, consisting of (i) $1.75 million in cash and (ii) $1.0 million evidenced by a three-year secured promissory note. The business divestiture of the U-Swirl segment was preceded by a separate sale of our three owned U-Swirl locations on February 24, 2023. With the sale of our frozen yogurt segment on May 1, 2023, we continue to focus on our confectionery business to further enhance our competitive position and operating margin, simplify our business model, and deliver sustainable value to our stockholders. The consolidated financial statements present the historical financial results of the former U-Swirl segment as discontinued operations for all periods presented. See Note 17 of the Notes to Consolidated Financial Statements included in Item 8, “Financial Statements and Supplementary Data", of this Annual Report for information on this divestiture.

Business Strategy

Our updated long term strategic objective is to build upon the solid market position of our brand and high-quality products to create a world-class experience for consumers of premium chocolate and confectionary products, whether in premium confection stores operated by our franchisees or by us, or purchased from us through a variety of other

3

channels. We intend to lead this effort through the delivery of an exceptional store experience and development of category leadership through innovation. To accomplish this objective, we will employ a business strategy that includes the elements set forth below.

Product Quality and Variety

We maintain the gourmet taste and quality of our chocolate products by using the finest chocolate and other wholesome ingredients. We use our proprietary recipes, primarily developed by our master candy makers. A typical Rocky Mountain Chocolate Factory store offers up to 100 of our chocolate products throughout the year and as many as 200, including many packaged products, during holiday seasons. Individual stores also offer numerous varieties of gourmet caramel apples as well as other products prepared in the store from Company recipes. We continue to enhance our product development and innovation capabilities through the Company’s in-house R&D department.

Store Atmosphere and Ambiance

We seek to establish a fun, enjoyable and inviting atmosphere in each of our store locations. Unlike most other confectionery stores, each Rocky Mountain Chocolate Factory store prepares numerous products, including caramel apples, in the store. In-store preparation is designed to be both fun and entertaining for customers. We believe the in-store preparation and aroma of our products enhances the ambiance at Rocky Mountain Chocolate Factory stores, and conveys an image of freshness and homemade quality. We have been, and are committed to, deploying increased resources to our retail store network to further improve the store experience and enhance profitability, all while maintaining brand standards.

Site Selection

Careful selection of a new retail site is critical to the success of our stores. We consider many factors in identifying suitable sites, including tenant mix, visibility, attractiveness, accessibility, level of foot traffic and occupancy costs. Final site selection occurs only after our senior management has approved the site.

Increase Same Store Retail Sales at Existing Rocky Mountain Chocolate Factory Stores

We seek to increase profitability of our store system by increasing sales at existing store locations through a combination of offering the optimal product assortment to stores, improving order fulfillment, facilitating increased product availability to stores through streamlined logistics, and providing Company personnel to help franchised locations improve their sales and profitability. We estimate that a 10% system-wide increase in revenues from our existing store base would be the equivalent of opening 15 new stores.

Changes in system-wide domestic same store retail sales at Rocky Mountain Chocolate Factory locations are as follows:

FY 2020 compared to FY 2019 |

|

|

0.5 |

% |

FY 2021 compared to FY 2020 |

|

|

(24.8 |

)% |

FY 2022 compared to FY 2021 |

|

|

62.4 |

% |

FY 2023 compared to FY 2022 |

|

|

0.5 |

% |

FY 2024 compared to FY 2023 |

|

|

(1.9 |

)% |

Same store sales declined during FY 2021 primarily as a result of nearly all of the franchise stores being directly and negatively impacted by public health measures taken in response to COVID-19, with nearly all locations experiencing reduced operations as a result of, among other things, modified business hours and store and mall closures. This decline was offset by a same store sales increase during FY 2022 when store operations resumed normal operations following the initial impacts of COVID-19.

4

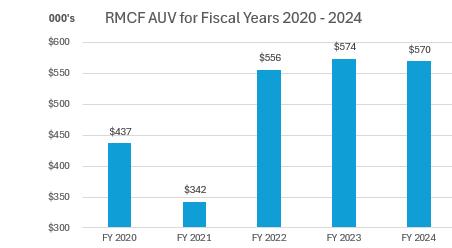

Increased System-Wide Annual Unit Volume (“AUV”)

A critical part of success in selling new franchises is the attractiveness of store level economics, which include robust and expanding system-wide annual sales. For FY 2024 our AUV was approximately $570,000, which represents a 30% increase from the FY 2020 AUV of $437,000.

Enhanced Operating Efficiencies

We have added highly experienced production and supply chain talent in order to bring sustained operating efficiencies to our Durango plant. In addition to such actions as investing in new and more efficient production equipment, we are rationalizing our portfolio of products and streamlining production lines to reduce labor costs as well as improve product quality and consistency.

Expansion Strategy

We are continually exploring opportunities to grow our brand and expand our business. Key elements of our expansion strategy are set forth below.

Unit Growth

We continue to pursue unit growth opportunities in locations where we have traditionally been successful, by improving and expanding our retail store concepts and product portfolio, and by targeting high pedestrian traffic environments.

High Traffic Environments

We currently establish franchised stores in the following environments: regional centers, outlet centers, tourist areas, street fronts, airports, other entertainment-oriented environments and festival and community centers. We have established business relationships with most of the major developers in the United States and believe that these relationships provide us with the opportunity to take advantage of attractive sites in new and existing real estate environments.

Multi-unit Operators

We have historically focused our franchise marketing efforts on single unit operators. By further enhancing our brand strength, product offering, and strong store experience, coupled with enhanced economics, we believe we will be able to appeal more, and market to, multi-unit operators looking to expand their portfolio of franchised opportunities into a premium chocolate franchise concept where we continue to identify substantial interest driven in large part by leased property owners.

Rocky Mountain Chocolate Factory Name Recognition and New Market Penetration

We believe the visibility of our stores and the high foot traffic at many of our locations has generated strong name recognition of Rocky Mountain Chocolate Factory and demand for our franchises. The Rocky Mountain Chocolate Factory system currently is concentrated in the western and Rocky Mountain region of the United States, but growth

5

has generated a gradual easterly momentum as new stores have been opened in the eastern half of the country. We believe this growth has further increased our name recognition and demand for our franchises. We believe that distribution of Rocky Mountain Chocolate Factory products through our Specialty Market business also increases name recognition and brand awareness in areas of the country in which we have not previously had a significant presence and we believe it will also improve and benefit our entire store system.

We seek to establish a fun, enjoyable and inviting atmosphere in each of our store locations. Unlike many other confectionery stores, each Rocky Mountain Chocolate Factory store prepares a variety of products, including caramel apples and fudge, in the store. In FY 2024, approximately one-half of the revenues of franchised stores were generated by sales of products prepared on premises. In-store preparation is designed to be both fun and entertaining for customers and we believe the in-store preparation and aroma of our products enhance the ambiance at Rocky Mountain Chocolate Factory stores, conveys an image of freshness and homemade quality.

The average store size is approximately 1,000 square feet, approximately 650 square feet of which is selling space. Most stores are open seven days a week.

In January 2007, we began testing co-branded locations, such as the co-branded stores with Cold Stone Creamery. Co-branding a location is a vehicle to develop retail environments that would not typically support a stand-alone Rocky Mountain Chocolate Factory store. Co-branding can also be used to more efficiently manage rent structure, payroll and other operating costs in environments that have not historically supported stand-alone Rocky Mountain Chocolate Factory stores. As of February 29, 2024, Cold Stone Creamery franchisees operated 104 co-branded locations, and U-Swirl franchisees operated 11 co-branded locations. As of February 29, 2024, the Company had 3 international units in operation, all within the Republic of the Philippines.

Products and Packaging

We produce approximately 400 chocolates and other confectionery products using proprietary recipes developed primarily by our master candy makers. These products include many varieties of clusters, caramels, creams, toffees, mints and truffles. These products are offered for sale and also configured into approximately 250 varieties of packaged assortments. During the Christmas, Easter and other holiday seasons, we make a variety of seasonal items, including many candies offered in packages, that are specially designed for holidays. A typical Rocky Mountain Chocolate Factory store offers up to 100 of these approximately 400 chocolate candies and other confectionery products throughout the year and up to an additional 90 during the holiday seasons. Individual stores also offer more than 15 varieties of caramel apples and other products prepared in the store. In FY 2024, approximately one-half of the revenues of Rocky Mountain Chocolate Factory stores were generated by products produced at our Durango production facility, and one-half of products made in individual stores using our recipes and ingredients purchased from us or approved suppliers and with a small amount of products such as ice cream, coffee and other sundries purchased from approved suppliers.

In FY 2024, approximately 10% of our Durango plant sales resulted from the sale of products outside of our system of franchised and licensed locations, which we refer to as Specialty Market customers, compared with 15% of our Durango plant sales resulting from Specialty Market customers in FY 2023. See Item 1A “Risk Factors—Risks Related to Our Company and Strategy—Our Sales to Specialty Market Customers, Customers Outside Our System of Franchised Stores, Are Concentrated Among a Small Number of Customers.” These products are produced using the same quality ingredients and production processes as the products sold in our network of retail stores.

We use the finest chocolates, nutmeats and other wholesome ingredients in our confectionary products and continually strive to offer new items in order to maintain the excitement and appeal of our offerings. We develop special packaging for the holidays and seasonal offerings, and consumers can have their purchases packaged in decorative boxes and fancy tins throughout the year.

Operating Environment

Rocky Mountain Chocolate Factory

We currently establish Rocky Mountain Chocolate Factory stores in six primary environments: outlet centers, festival and community centers, regional centers, tourist areas, street fronts, airports and other entertainment-oriented

6

shopping centers. Each of these environments has a number of attractive features, including high levels of foot traffic. Rocky Mountain Chocolate Factory domestic franchise locations in operation as of February 29, 2024, include:

Outlet Centers |

|

|

19.4 |

% |

Festival/Community Centers |

|

|

20.8 |

% |

Regional Centers |

|

|

19.5 |

% |

Tourist Areas |

|

|

20.8 |

% |

Street Fronts |

|

|

10.1 |

% |

Airports |

|

|

5.4 |

% |

Other |

|

|

4.0 |

% |

Outlet Centers

As of February 29, 2024, there were approximately 29 Rocky Mountain Chocolate Factory stores in outlet centers. We have established business relationships with a number of the major outlet center developers in the United States. Although not all factory outlet centers provide desirable locations for our stores, we believe our relationships with these developers will provide us with the opportunity to take advantage of attractive sites in new and existing outlet centers.

Festival and Community Centers

As of February 29, 2024, there were approximately 31 Rocky Mountain Chocolate Factory stores in festival and community centers. Festival and community centers offer retail shopping outside of traditional regional and outlet center shopping.

Regional Centers

As of February 29, 2024, there were Rocky Mountain Chocolate Factory stores in approximately 29 regional centers, including a location in the Mall of America in Bloomington, Minnesota. Although they often provide favorable levels of foot traffic, regional centers typically involve more expensive rent structures and competing food and beverage concepts.

Tourist Areas, Street Fronts, Airports and Other Entertainment-Oriented Shopping Centers

As of February 29, 2024, there were approximately 31 Rocky Mountain Chocolate Factory stores in locations considered to be tourist areas. Tourist areas are very attractive locations because they offer high levels of foot traffic and favorable customer spending characteristics, and greatly increase our visibility and name recognition. We believe there are a number of other environments that have the characteristics necessary for the successful operation of Rocky Mountain Chocolate Factory stores such as airports and casinos. As of February 29, 2024, there were 8 franchised Rocky Mountain Chocolate Factory stores at airport locations.

Franchising Program

General

We continue to attract qualified and experienced franchisees, whom we consider to be a vital part of our continued growth. We believe our relationship with our franchisees is fundamental to the performance of our brand and we strive to maintain a collaborative relationship with our franchisees. Our franchising philosophy is one of service and commitment to our franchise system and we continuously seek to improve our franchise support services. Our concept has been rated as an outstanding franchise opportunity by publications and organizations rating such opportunities. The Rocky Mountain Chocolate Factory concept has frequently been ranked in the Top 500 Franchises by Entrepreneur Magazine.

Franchisee Sourcing and Selection

The majority of new franchises are awarded to persons referred to us by existing franchisees, to interested consumers who have visited one of our domestic franchise locations and to existing franchisees. We also advertise for new

7

franchisees in national and regional newspapers and online as suitable potential store locations come to our attention. We are exploring the use of third-party franchise lead generators to supplement our efforts. Franchisees are currently approved by a committee of the senior executive team based on the applicant's net worth and liquidity, business acumen, and prior experience with franchising and/or fast moving consumer goods (“FMCG”), together with an assessment of work ethic and personality compatibility with our operating philosophy.

International Franchising and Licensing

International growth is generally achieved through entry into a Master License Agreement covering specific countries, with a licensee that meets minimum qualifications to develop Rocky Mountain Chocolate Factory in that country. License agreements are generally entered into for a period of 3-10 years and allow the licensee exclusive development rights in a country. Generally, we require an initial license fee and commitment to a development schedule. Active international license agreements in place include the following:

Co-Branding

In August 2009, we entered into a Master License Agreement with Kahala Franchise Corp. Under the terms of the agreement, select current and future Cold Stone Creamery franchise stores are co-branded with both the Rocky Mountain Chocolate Factory and the Cold Stone Creamery brands. Locations developed or modified under the agreement are subject to the approval of both parties. Locations developed or modified under the agreement will remain franchisees of Cold Stone Creamery and will be licensed to offer the Rocky Mountain Chocolate Factory brand. As of February 29, 2024, Cold Stone Creamery franchisees operated 104 stores under this agreement.

Additionally, we allow U-Swirl brands to offer Rocky Mountain Chocolate Factory products under terms similar to other co-branding agreements. As of February 29, 2024, there were 11 U-Swirl cafés offering Rocky Mountain Chocolate Factory products.

Training and Support

Each domestic franchisee owner/operator and each store manager for a domestic franchisee is required to complete a comprehensive training program in store operations and management. We have established a training center at our Durango headquarters in the form of a full-sized replica of a properly configured and merchandised Rocky Mountain Chocolate Factory store. Topics covered in the training course include our philosophy of store operation and management, customer service, merchandising, pricing, cooking, inventory and cost control, quality standards, record keeping, labor scheduling and personnel management. Training is based on standard operating policies and procedures contained in an operations manual provided to all franchisees, which the franchisee is required to follow by terms of the franchise agreement. Additionally, and importantly, trainees are provided with a complete orientation to our operations by working in key factory operational areas and by meeting with members of our senior management.

Our operating objectives include providing knowledge and expertise in merchandising, marketing and customer service to all front-line store level employees to maximize their skills and ensure that they are fully versed in our operational techniques.

We provide ongoing support to franchisees through our field consultants, who maintain regular and frequent communication with the stores by phone and by site visits. The field consultants also review and discuss store operating results with the franchisee and provide advice and guidance in improving store profitability and in developing and executing store marketing and merchandising programs.

Quality Standards and Control

The franchise agreements for Rocky Mountain Chocolate Factory brand franchisees require compliance with our procedures of operation and food quality specifications and permit audits and inspections by us.

8

Operating standards for Rocky Mountain Chocolate Factory brand stores are set forth in operating manuals. These manuals cover general operations, factory ordering, merchandising, advertising and accounting procedures. Through their regular visits to franchised stores, our field consultants audit performance and adherence to our brand standards. We have the right to terminate any franchise agreement for non‑compliance with our operating standards. Products sold at the stores and ingredients used in the preparation of products approved for on-site preparation must be purchased from us or from approved suppliers.

The Franchise Agreement: Terms and Conditions

The domestic offer and sales of our franchise concepts are made pursuant to the respective franchise disclosure document (FDD) prepared in accordance with federal and state laws and regulations. States that regulate the sale and operation of franchises require a franchisor to register or file certain notices with the state authorities prior to offering and selling franchises in those states.

Under the current form of our domestic franchise agreements, franchisees pay us (i) an initial franchise fee for each store, (ii) royalties based on monthly gross sales, and (iii) a marketing fee based on monthly gross sales. Franchisees are generally granted exclusive territory with respect to the operation of their stores only in the immediate vicinity of their stores. Chocolate products not made on premises by franchisees must be purchased from us or approved suppliers. The franchise agreements require franchisees to comply with our procedures of operation and food quality specifications, to permit inspections and audits by us and to remodel stores to conform with standards then in effect. We may terminate the franchise agreement upon the failure of the franchisee to comply with the conditions of the agreement and upon the occurrence of certain events, such as insolvency or bankruptcy of the franchisee or the commission by the franchisee of any unlawful or deceptive practice, which in our judgment is likely to adversely affect the network system. Our ability to terminate franchise agreements pursuant to such provisions is subject to applicable bankruptcy and state laws and regulations. See “Regulation” below for additional information.

The agreements prohibit the transfer or assignment of any interest in a franchise without our prior written consent. The agreements also give us a right of first refusal to purchase any interest in a franchise if a proposed transfer would result in a change of control of that franchise. The refusal right, if exercised, would allow us to purchase the interest proposed to be transferred under the same terms and conditions and for the same price as offered by the proposed transferee.

The term of franchise agreements signed before July 1, 2023 is ten years, and franchisees have the right to renew for one additional ten-year term. The term of franchise agreements signed after July 1, 2023 is ten years, and franchisees have the right to renew for two additional five-year terms. Our revised Franchise Agreement offers a flat royalty payment on all retail stores sales ranging from 6% to as low as 4% based upon the retail sales mix of Durango produced product sold in comparison to all retail store sales. These terms are only effective with Franchise Agreements entered into after July 1, 2023 or when a current franchise operator agrees to enter into a new agreement with the Company

Franchise Financing

We do not typically provide prospective franchisees with financing for their stores for new or existing franchises, but we have developed relationships with several sources of franchisee financing to whom we will refer franchisees. Typically, franchisees have obtained their own sources of such financing and have not required our assistance. In the normal course of business, we extend credit to customers, primarily franchisees that satisfy pre-defined credit criteria, for inventory and other operational costs.

In select instances, we have provided limited financing to franchisees. As a result, as of February 29, 2024, we have approximately $0.2 million of notes receivable as a result of financing our franchisees. When we finance franchisees the notes are secured by the assets financed.

Company Store Operations

As of February 29, 2024, there were two Company-owned Rocky Mountain Chocolate Factory stores. Our flagship store, located in Durango, Colorado, (“Flagship Store”) provides a training ground for Company personnel and a controllable testing ground for new products and promotions, operating and training methods and merchandising techniques, which may then be incorporated into the franchise store operations.

9

Production Operations

General

We manufacture our chocolate and confectionary products at our production facility in Durango, Colorado. All products are produced consistent with our philosophy of using the finest high-quality ingredients to achieve our marketing motto of “The Peak of Perfection in Handmade Chocolates®.”

We have always believed that we should control the production of our own chocolate products. By controlling operations and production, we are able to better maintain our high quality standards, offer unique proprietary products, control production and shipment schedules and potentially pursue new or under-utilized distribution channels.

Production Processes

The production process primarily involves cooking or preparing candy centers, including nuts, caramel, peanut butter, creams and jellies, and then coating them with chocolate or other toppings. All of these processes are conducted in carefully controlled temperature ranges, and we employ strict quality control procedures at every stage of the production process. We use a combination of manual and automated processes at production facility. Although we believe that it is currently preferable to perform certain production processes, such as the dipping of some large pieces by hand, automation increases the speed and efficiency of the production process. We have from time-to-time automated certain processes formerly performed by hand where it has become cost-effective for us to do so without compromising product quality or appearance.

We also seek to ensure the freshness of products sold in Rocky Mountain Chocolate Factory stores with frequent shipments. Most Rocky Mountain Chocolate Factory stores do not have significant space for the storage of inventory, and we encourage franchisees and store managers to order only the quantities that they can reasonably expect to sell within approximately two to four weeks. For these reasons, we generally do not have a significant backlog of orders.

The production and sale of consumer food products is highly regulated. In the U.S., our activities are subject to regulation by various government agencies, including the Food and Drug Administration (“FDA”), the Department of Agriculture, the Federal Trade Commission, the Department of Commerce and the Environmental Protection Agency, as well as various state and local agencies. Similar agencies also regulate our businesses outside of the U.S.

We have a product quality and safety program. This program is integral to our supply chain platform and is intended to ensure that all products we purchase, produce, and distribute are safe, are of high quality and comply with applicable laws and regulations. Through our product quality and safety program, we evaluate our supply chain including ingredients, packaging, processes, products, distribution and the environment to determine where product quality and safety controls are necessary. We follow the FDA mandated Hazard Analysis and Risk-based Preventive Controls which includes a 12-step process to determine risks based on individual processes. To support this hazard analysis model, and in accordance with private and federal mandated requirements, we also adhere to all good manufacturing practices ("GMPs") including several supporting policies and procedures that ensure all risks identified are in control. Various government agencies and third-party firms, as well as our quality assurance staff, conduct audits of all facilities that produce our products to ensure effectiveness and compliance with our program and applicable laws and regulations.

Ingredients

The principal ingredients used in our products are chocolate, nuts, sugar, corn syrup, cream and butter. Our production facility receives shipments of ingredients daily. To ensure the consistency of our products, we buy ingredients from a limited number of reliable suppliers. In order to ensure a continuous supply of chocolate and certain nuts, we frequently enter into purchase contracts of between six to eighteen months for these products. Because prices for these products may fluctuate, we may benefit if prices rise during the terms of these contracts, but we may be required to pay above-market prices if prices fall. We have one or more alternative sources for most essential ingredients and therefore believe that the loss of any one supplier would not have a material adverse effect on our business or results of operations. We currently purchase small amounts of finished candy from third parties on a private label basis for sale in Rocky Mountain Chocolate Factory stores. As a result of recent macro-economic inflationary trends and disruptions to the global supply chain, we have experienced and may continue to experience higher raw material, labor, and freight costs.

10

Trucking Operations

We operate eight trucks and ship a substantial portion of our products from the production facility on our own fleet. Our trucking operations enable us to deliver our products to the stores quickly and cost-effectively. In addition, we back-haul our own ingredients and supplies, as well as products from third parties, on return trips, which helps achieve even greater efficiencies and cost savings.

Marketing

General

We rely primarily on in-store promotion and point-of-purchase materials to promote the sale of our products. The monthly marketing fees collected from franchisees are used by us to develop new packaging and in-store promotion and point-of-purchase materials, and to create and update our local store marketing guides and materials.

We focus on local store marketing efforts by providing customizable marketing materials, including advertisements, coupons, flyers and brochures generated by our in-house Creative Services department. The department works directly with franchisees to implement local store marketing programs.

We have not historically, and do not intend to, engage in national traditional media advertising in the near future. Consistent with our commitment to community support, we seek opportunities to participate in local and regional events, sponsorships and charitable causes. This support leverages low-cost, high return publicity opportunities for mutual gain partnerships.

Internet and Social Media

We’ve initiated a program to leverage the marketing benefits of various social media outlets. These lower-cost marketing opportunities leverage the positive feedback of our customers, expanding brand awareness through a customer’s network of contacts. Complementary to local store marketing efforts, these networks also provide a medium for us to communicate regularly and authentically with customers. When possible, we work to facilitate direct relationships between our franchisees and their customers. We use social media as a tool to build brand recognition, increase repeat exposure, and enhance dialogue with consumers about their preferences and needs. The majority of stores have location-specific Facebook® and Instagram® accounts dedicated to helping customers interact directly with their local store. Proceeds from the monthly marketing fees collected from franchisees are used by us to facilitate and assist stores in managing their online presence consistent with our brand and marketing efforts.

Competition

The retailing of confectionery products is highly competitive. We and our franchisees compete with numerous businesses that offer products similar to those offered by our retail stores and Specialty Markets. Many of these competitors have greater name recognition and financial, marketing and other resources than us. In addition, there is intense competition among retailers for attractive commercial real estate sites suitable for Rocky Mountain Chocolate Factory stores, store personnel and qualified franchisees.

We believe that our principal competitive strengths lie in our name recognition and our reputation for the quality, value, variety and taste of our products and the ambiance of our stores; our knowledge and experience in applying criteria for the selection of new store locations; our expertise in merchandising and marketing of chocolate and other confectionary products; and the control and training infrastructures we have implemented to ensure execution of successful practices and techniques at our retail store locations. In addition, by controlling the production of our own confectionary products, we can better maintain our high product quality standards for those products, offer proprietary products, manage costs, control production and shipment schedules and pursue new or under-utilized distribution channels.

11

Trade Name and Trademarks

The trade name “Rocky Mountain Chocolate Factory®,” the phrases, “The Peak of Perfection in Handmade Chocolates®”, “America's Chocolatier®” as well as all other trademarks, service marks, symbols, slogans, emblems, logos and designs used in the Rocky Mountain Chocolate Factory system, are our proprietary rights. We believe all of the foregoing are of material importance to our business. The trademark “Rocky Mountain Chocolate Factory” is registered in the United States and Canada. Applications to register the Rocky Mountain Chocolate Factory trademark have been filed and/or obtained in certain foreign countries.

We have not attempted to obtain patent protection for the proprietary recipes developed by our master candy-maker and instead rely upon our ability to maintain the confidentiality of those recipes.

Environmental Matters

We are not aware of any federal, state, local or international environmental laws or regulations that we expect to materially affect our earnings or competitive position or result in material capital expenditures. However, we cannot predict the effect of possible future environmental legislation or regulations on our operations. During FY 2024, we had no material environmental compliance-related capital expenditures, and no such material expenditures are anticipated in FY 2025.

Seasonal Factors

Our sales and earnings are seasonal, with significantly higher sales and earnings occurring during key holidays, such as Christmas, Easter and Valentine's Day, and the U.S. summer vacation season than at other times of the year, which may cause fluctuations in our quarterly results of operations. In addition, quarterly results have been, and in the future are likely to be, affected by the timing of new store openings, the sale of franchises and the timing of purchases by customers outside our network of franchised locations. Because of the seasonality of our business, results for any quarter are not necessarily indicative of the results that may be achieved in other quarters or for a full fiscal year.

Regulation

Our two current Company-owned and other franchised Rocky Mountain Chocolate Factory stores are subject to licensing and regulation by the health, sanitation, safety, building and fire agencies in the state or municipality where located. Difficulties or failures in obtaining the required licensing or approvals could delay or prevent the opening of new stores. New stores must also comply with landlord and developer criteria.

Many states have laws regulating franchise operations, including registration and disclosure requirements in the offer and sale of franchises. We are also subject to the Federal Trade Commission regulations relating to disclosure requirements in the sale of franchises and ongoing disclosure obligations.

Additionally, certain states have enacted and others may enact laws and regulations governing the termination or non-renewal of franchises and other aspects of the franchise relationship that are intended to protect franchisees, including among other things, limitation on the duration and scope of non-competition provisions applicable to franchisees. Although these laws and regulations, and related court decisions, may limit our ability to terminate franchises and alter franchise agreements, we do not believe that such laws or decisions will have a material adverse effect on our franchise operations. However, the laws applicable to franchise operations and relationships continue to develop, and we are unable to predict the effect on our intended operations of additional requirements or restrictions that may be enacted or of court decisions that may be adverse to franchisors.

Federal and state environmental regulations have not had a material impact on our operations but more stringent and varied requirements of local governmental bodies with respect to zoning, land use and environmental factors could delay the construction of new stores, increase our capital expenditures and thereby decrease our earnings and negatively impact our competitive position.

12

Companies engaged in the production, packaging and distribution of food products are subject to extensive regulation by various governmental agencies. A finding of failure to comply with one or more regulations could result in the imposition of sanctions, including the closing of all or a portion of our facilities for an indeterminate period of time. Our product labeling is subject to and complies with the Nutrition Labeling and Education Act of 1990 and the Food Allergen Labeling and Consumer Protection Act of 2004.

We provide a limited amount of trucking services to third parties, to fill available space on our trucks. Our trucking operations are subject to various federal and state regulations, including regulations of the Federal Highway Administration and other federal and state agencies applicable to motor carriers, safety requirements of the Department of Transportation relating to interstate transportation and federal, state and Canadian provincial regulations governing matters such as vehicle weight and dimensions.

We believe that we are operating in substantial compliance with all applicable laws and regulations.

Human Capital Resources

As of February 29, 2024, we employed approximately 160 people, including 135 full-time employees. Most employees, with the exception of store management, production management and corporate management, are paid on an hourly basis. We also employ some individuals on a temporary basis during peak periods of store and factory operations. We seek to ensure that participatory management processes, mutual respect and professionalism and high-performance expectations for the employees exist throughout the organization. We believe that we provide working conditions, wages and benefits that compare favorably with those of our competitors. Our employees are not covered by a collective bargaining agreement. We consider our employee relations to be good.

Our franchisees are independent business owners, their employees are not our employees and therefore are not included in our employee count.

Labor and Supply Chain

As a result of recent macroeconomic inflationary trends and disruptions to the global supply chain, we have experienced and expect to continue experiencing higher raw material, labor, and freight costs. We have seen labor and logistics challenges, which we believe have contributed to lower production facility, retail, and e-commerce sales of our products due to the availability of material, labor, and freight. In addition, we could experience additional lost sales opportunities if our products are not available for purchase as a result of continued disruptions in our supply chain relating to an inability to obtain ingredients or packaging, labor challenges at our logistics providers or our production facility, or if we or our franchisees experience delays in stocking our products. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a discussion of recent business developments.

Our principal executive offices are located at 265 Turner Drive, Durango, Colorado 81303, and our telephone number is (970) 259-0554. We have retail store locations throughout the Unites Stated and the Philippines. Our website address is www.rmcf.com. Information contained on or accessible through our websites is neither a part of this Annual Report nor incorporated by reference herein.

Ethics and Governance

We have adopted the Rocky Mountain Chocolate Factory Code of Conduct, which qualifies as a code of ethics under Item 406 of Regulation S-K. The code applies to all of our employees, officers, including our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions, and directors. Our Code of Conduct is available free of charge on our website at https://ir.rmcf.com/corporate-governance/governance-documents. We will disclose any waiver we grant to an executive officer or director under our code of ethics, or certain amendments to the Code of Conduct, on our website.

13

In addition, we have adopted Code of Ethics for Senior Financial Officers, charters for each of the Board’s four standing committees and the Whistleblower/Complaint Procedures for Accounting and Auditing Matters. All of these materials are available on our web site at https://ir.rmcf.com/corporate-governance/governance-documents.

Available Information

The Internet address of our website is www.rmcf.com. Additional websites specific to our franchise opportunities and investor relations are www.sweetfranchise.com and https://ir.rmcf.com, respectively.

We file or furnish annual, quarterly and current reports, proxy statements and other information with the United States Securities and Exchange Commission (“SEC”). We make available free of charge, through our Internet website, our Annual Report, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC also maintains a website that contains these reports, proxy and information statements and other information that can be accessed, free of charge, at www.sec.gov. The contents of our websites are not incorporated into, and should not be considered a part of, this Annual Report.

ITEM 1A. RISK FACTORS

Our business, results of operations and financial position are subject to various risks, including those discussed below, which may affect the value of our common stock. The following risk factors, which we believe represent the most significant factors that may make an investment in our common stock risky, may cause our actual results to differ materially from those projected in any forward-looking statement. You should carefully consider these factors, as well as the other information contained in this Annual Report, including the information set forth in “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Results of Operations and Financial Position,” when evaluating an investment in our common stock.

Risks Specific to Our Company and the Industry in Which We Operate

Our Sales To Specialty Market Customers, Customers Outside Our System Of Franchised Stores, Are Concentrated Among A Small Number Of Customers.

The Company has historically sold its product to relatively few customers outside its network of franchised and licensed locations (Specialty Market customers).

During FY 2024 our sales to Specialty Market customers were approximately $2.7 million or 10% of our total revenue.

The Divestiture Of Our U-Swirl Business May Have Material Adverse Effects On Our Financial Condition, Results Of Operations Or Cash Flows.

In May 2023, subsequent to our fiscal year-end, we announced that we had completed the sale of substantially all of the assets of U-Swirl, our wholly-owned subsidiary and frozen yogurt business. The consummation of the sale of the U-Swirl business involves risks, including retention of uncertain contingent liabilities related to the divested business and risks associated with the collection of notes receivable contemplated in the sale, any of which could result in a material adverse effect to our financial condition, results of operations or cash flows. We cannot be certain that we will be successful in managing these or any other significant risks that we encounter as a result of divesting the U-Swirl business.

Our Growth Is Dependent Upon Attracting And Retaining Qualified Franchisees And Their Ability To Operate Their Franchised Stores Successfully.

Our continued growth and success are dependent in part upon our ability to attract, retain and contract with qualified franchisees. Our growth is dependent upon the ability of franchisees to operate their stores successfully, promote and develop our store concepts, and maintain our reputation for an enjoyable in-store experience and high-quality products. Although we have established criteria to evaluate prospective franchisees and have been successful in attracting franchisees, there can be no assurance that franchisees will be able to operate successfully in their franchise areas in a manner consistent with our concepts and standards. As a result, we may realize a reduction in number of units in operation or fail to achieve our opening targets.

14

Increases In Costs Could Adversely Affect Our Operations.

Inflationary factors such as increases in the costs of ingredients, energy and labor directly affect our operations. Most of our leases provide for cost-of-living adjustments and require us to pay taxes, insurance and maintenance expenses, all of which are subject to inflation. Additionally, our future lease costs for new facilities may reflect potentially escalating costs of real estate and construction. There is no assurance that we will be able to pass on our increased costs to our customers or that our customers will continue to purchase at historical levels in the event that we pass along cost increases in the form of higher prices. If we are unable to pass along cost increases we may realize a decrease in gross margin on products we sell and produce.

Price Increases May Not Be Sufficient To Offset Cost Increases And Maintain Profitability Or May Result In Sales Volume Declines Associated With Pricing Elasticity.

We may be able to pass some or all raw materials, energy and other input cost increases to customers by increasing the selling prices of our products, however, higher product prices may also result in a reduction in sales volume and/or consumption. If we are not able to increase our selling prices sufficiently, or in a timely manner, to offset increased raw material, energy or other input costs, including packaging, direct labor, overhead and employee benefits, or if our sales volume decreases significantly, there could be a negative impact on our financial condition and results of operations.

Our Expansion Plans Are Dependent On The Availability Of Suitable Sites For Franchised Stores At Reasonable Occupancy Costs.

Our expansion plans are critically dependent on our ability to obtain suitable sites for franchised stores at reasonable occupancy costs for our franchised stores in high foot traffic retail environments. There is no assurance that we will be able to obtain suitable locations for our franchised stores in this environment at a cost that will allow such stores to be economically viable.

Same Store Sales Have Fluctuated and Will Continue to Fluctuate.

Our same store sales, defined as year-over-year sales for a store that has been open for at least one year, have fluctuated in the past on an annual and quarterly basis and are expected to continue to fluctuate in the future. Sustained declines in same store sales or significant same store sales declines in any single period could have a material adverse effect on our results of operations. Same store sales declined during FY 2021 and established the large negative percentage changes reflected above, primarily as a result of nearly all of the franchise stores being directly and negatively impacted by public health measures taken in response to COVID-19, with nearly all locations experiencing reduced operations as a result of, among other things, modified business hours and store and mall closures. Same store sales increased during FY 2022 and established the large positive percentage changes reflected above, primarily as a result of nearly all of the franchise stores being directly and positively impacted by a resurgence in consumer demand following the relaxing of many public health measures taken in response to COVID-19. If same store sales decline, we may experience a decrease in demand for products we sell and a decrease in revenue from royalty and marketing fees.

Higher Labor Costs, Increased Competition For Qualified Team Members And Ensuring Adequate Staffing Increases The Cost Of Doing Business. Additionally, Changes In Employment And Labor Laws, Including Health Care Legislation And Minimum Wage Increases, Could Increase Costs For Our System-Wide Operations.

Our success depends in part on our and our franchisees’ ability to recruit, motivate, train and retain a qualified workforce to work in our stores in an intensely competitive environment. We and our franchisees have experienced, and could continue to experience, a shortage of labor for stores positions due to job market trends and conditions, which could decrease the pool of available qualified talent for key functions. Our ability to attract and retain hourly employees in our stores and factory has been impacted by these trends and conditions, and we expect staffing and labor challenges to continue into 2025. Increased costs associated with recruiting, motivating and retaining qualified employees to work in the Company-owned stores, franchised stores and our production facility have had, and may in the future have, a negative impact on our Company-owned store and production margins and the margins of franchised stores. Competition for qualified drivers for both our stores and supply-chain function also continues to increase as

15

more companies compete for drivers or enter the delivery space, including third party aggregators. Additionally, economic actions, such as boycotts, protests, work stoppages or campaigns by labor organizations, could adversely affect us (including our ability to recruit and retain talent) or our franchisees and suppliers. Social media may be used to foster negative perceptions of employment with our Company in particular or in our industry generally, and to promote strikes or boycotts.

We are also subject to federal, state and foreign laws governing such matters as minimum wage requirements, overtime compensation, benefits, working conditions, citizenship requirements and discrimination and family and medical leave and employee related litigation. Labor costs and labor-related benefits are primary components in the cost of operation. Labor shortages, increased employee turnover and health care mandates could increase our system-wide labor costs.

A significant number of hourly personnel are paid at rates at or above the federal and state minimum wage requirements. Accordingly, the enactment of additional state or local minimum wage increases above federal wage rates or regulations related to exempt employees has increased and could continue to increase labor costs for our domestic system-wide operations. A significant increase in the federal minimum wage requirement could adversely impact our financial condition and results of operations.

The Seasonality Of Our Sales And New Store Openings Can Have A Significant Impact On Our Financial Results From Quarter To Quarter.

Our sales and earnings are seasonal, with significantly higher sales and earnings occurring during key holidays and summer vacation season than at other times of the year, which causes fluctuations in our quarterly results of operations. In addition, quarterly results have been, and in the future are likely to be, affected by the timing of new store openings and the sale of franchises. Because of the seasonality of our business and the impact of new store openings and sales of franchises, results for any quarter are not necessarily indicative of the results that may be achieved in other quarters or for a full fiscal year.

The Retailing Of Confectionery Products Is Highly Competitive And Many Of Our Competitors Have Competitive Advantages Over Us.

The retailing of confectionery products is highly competitive. We and our franchisees compete with numerous businesses that offer similar products. Many of these competitors have greater name recognition and financial, marketing and other resources than we do. In addition, there is intense competition among retailers for real estate sites, store personnel and qualified franchisees. Competitive market conditions could have a material adverse effect on us and our results of operations and our ability to expand successfully.

Changes In Consumer Tastes And Trends Could Have A Material Adverse Effect On Our Operations.

The sale of our products is affected by changes in consumer tastes and health concerns, including views regarding the consumption of chocolate. Numerous other factors that we cannot control, such as economic conditions, demographic trends, traffic patterns and weather conditions, influence the sale of our products. Changes in any of these factors could have a material adverse effect on us and our results of operations.

We Are Subject To Federal, State And Local Regulations.

We are subject to regulation by the Federal Trade Commission and must comply with certain state laws governing the offer, sale and termination of franchises and the refusal to renew franchises. Many state laws also regulate substantive aspects of the franchisor-franchisee relationship by, for example, requiring the franchisor to deal with its franchisees in good faith, prohibiting interference with the right of free association among franchisees and regulating discrimination among franchisees in charges, royalties or fees. Franchise laws continue to develop and change, and changes in such laws could impose additional costs and burdens on franchisors. Our failure to obtain approvals to sell franchises and the adoption of new franchise laws, or changes in existing laws, could have a material adverse effect on us and our results of operations.

Each of our Company-owned and franchised stores is subject to licensing and regulation by the health, sanitation, safety, building and fire agencies in the state or municipality where located. Difficulties or failures in obtaining required licenses or approvals from such agencies could delay or prevent the opening of a new store. We and our

16

franchisees are also subject to laws governing our relationships with employees, including minimum wage requirements, overtime, working and safety conditions and citizenship requirements. Because a significant number of our employees are paid at rates related to the state minimum wage, increases in the minimum wage would increase our labor costs. The failure to obtain required licenses or approvals, or an increase in the minimum wage rate, employee benefits costs (including costs associated with mandated health insurance coverage) or other costs associated with employees, could have a material adverse effect on us and our results of operations.

Companies engaged in the production, packaging and distribution of food products are subject to extensive regulation by various governmental agencies. A finding of failure to comply with one or more regulations could result in the imposition of sanctions, including the closing of all or a portion of our facilities for an indeterminate period of time, and could have a material adverse effect on us and our results of operations.

Information Technology System Failures, Breaches Of Our Network Security Or Inability To Upgrade Or Expand Our Technological Capabilities Could Interrupt Our Operations And Adversely Affect Our Business.

We and our franchisees rely on our computer systems and network infrastructure across our operations, including point-of-sale (POS) processing at our stores. Our and our franchisees’ operations depend upon our and our franchisees’ ability to protect our computer equipment and systems against damage from physical theft, fire, power loss, telecommunications failure or other catastrophic events, as well as from internal and external cybersecurity breaches, viruses and other disruptive problems. Any damage or failure of our computer systems or network infrastructure that causes an interruption in our operations could have a material adverse effect on our business and subject us or our franchisees to litigation or to actions by regulatory authorities. Furthermore, the importance of such information technology systems and networks increased in FY 2021 and continued into FY 2022, FY 2023 and FY 2024 due to many of our employees working remotely as a result of the COVID-19 pandemic.

A party who is able to compromise the security measures on our networks or the security of our infrastructure could, among other things, misappropriate our proprietary information and the personal information of our customers and employees, cause interruptions or malfunctions in our or our franchisee’s operations, cause delays or interruptions to our ability to operate, cause us to breach our legal, regulatory or contractual obligations, create an inability to access or rely upon critical business records or cause other disruptions in our operations. These breaches may result from human errors, equipment failure, fraud, or malice on the part of employees or third parties.

We expend financial resources to protect against such threats and may be required to further expend financial resources to alleviate problems caused by physical, electronic, and cyber security breaches. As techniques used to breach security are growing in frequency and sophistication and are generally not recognized until launched against a target, regardless of our expenditures and protection efforts, we may not be able to implement security measures in a timely manner or, if and when implemented, these measures could be circumvented. Any breaches that may occur could expose us to an increased risk of lawsuits, loss of existing or potential future customers, harm to our reputation and increases in our security costs, which could have a material adverse effect on our financial performance and operating results.

In the event of a breach resulting in loss of data, such as personally identifiable information or other such data protected by data privacy or other laws, we may be liable for damages, fines and penalties for such losses under applicable regulatory frameworks despite not handling the data. Further, the regulatory framework around data custody, data privacy and breaches varies by jurisdiction and is an evolving area of law. We may not be able to limit our liability or damages in the event of such a loss.

We are also continuing to expand, upgrade and develop our information technology capabilities, including our point-of-sale systems, as well as the adoption of cloud services for e-mail, intranet, and file storage. If we are unable to successfully upgrade or expand our technological capabilities, we may not be able to take advantage of market opportunities, manage our costs and transactional data effectively, satisfy customer requirements, execute our business plan or respond to competitive pressures. Additionally, unforeseen problems with our point-of-sale system may affect our operational abilities and internal controls and we may incur additional costs in connection with such upgrades and expansion.

If We, Our Business Partners, Or Our Franchisees Are Unable To Protect Our Customers’ Data, We Could Be Exposed To Data Loss, Litigation, Liability And Reputational Damage.

17

In connection with credit and debit card sales, we and our franchisees transmit confidential credit and debit card information by way of secure private retail networks. A number of retailers have experienced actual or potential security breaches in which credit and debit card information may have been stolen. Although we and our franchisees use private networks, third parties may have the technology or know-how to breach the security of the customer information transmitted in connection with credit and debit card sales, and our and our franchisees’ security measures and those of our and our franchisees’ technology vendors may not effectively prohibit others from obtaining improper access to this information. If a person were able to circumvent these security measures, he or she could destroy or steal valuable information or disrupt our and our franchisees’ operations. Any security breach could expose us and our franchisees to risks of data loss and liability and could seriously disrupt our and our franchisees’ operations and any resulting negative publicity could significantly harm our reputation. We may also be subject to lawsuits or other proceedings in the future relating to these types of incidents. Proceedings related to the theft of credit and debit card information may be brought by payment card providers, banks, and credit unions that issue cards, cardholders (either individually or as part of a class action lawsuit), and federal and state regulators. Any such proceedings could harm our reputation, distract our management team members from running our business and cause us to incur significant unplanned liabilities, losses and expenses.

We also sell and accept for payment gift cards, and our customer loyalty program provides rewards that can be redeemed for purchases. Like credit and debit cards, gift cards, and rewards earned by our customers are vulnerable to theft, whether physical or electronic. We believe that, due to their electronic nature, rewards earned through our customer loyalty program are primarily vulnerable to hacking. Customers affected by any loss of data or funds could litigate against us, and security breaches or even unsuccessful attempts at hacking could harm our reputation, and guarding against or responding to hacks could require significant time and resources.

We also receive and maintain certain personal information about our customers, including information received through our marketing programs, franchisees and business partners. Our collection, storage, handling, use, disclosure and security of this information is regulated by U.S. federal, state and local and foreign laws and regulations. If our security and information systems are compromised or our employees fail to comply with these laws and regulations and this information is obtained by unauthorized persons or used inappropriately, it could adversely affect our reputation, as well as the results of operations, and could result in litigation against us or the imposition of penalties. In addition, our ability to accept credit and debit cards as payment in our stores and online depends on us maintaining our compliance status with standards set by the PCI Security Standards Council. These standards, set by a consortium of the major credit card companies, require certain levels of system security and procedures to protect our customers’ credit and debit card information as well as other personal information. Privacy and information security laws and regulations change over time, and compliance with those changes may result in cost increases due to necessary system and process changes.

We Are Subject To Periodic Litigation, Which Could Result In Unexpected Expenses Of Time And Resources.

From time to time, we are called upon to defend ourselves against lawsuits relating to our business. Due to the inherent uncertainties of litigation, we cannot accurately predict the ultimate outcome of any such proceedings. An unfavorable outcome in any current or future legal proceedings could have an adverse impact on our business, and financial results. In addition, any significant litigation in the future, regardless of its merits, could divert management's attention from our operations and result in substantial legal fees. Any litigation could result in substantial costs and a diversion of management's attention and resources that are needed to successfully run our business.

Changes In Health Benefit Claims And Healthcare Reform Legislation Could Have A Material Adverse Effect On Our Operations.

We accrue for costs to provide self-insured benefits for our employee health benefits program. We accrue for self-insured health benefits based on historical claims experience and we maintain insurance coverage to prevent financial losses from catastrophic health benefit claims. We monitor pending and enacted legislation in an effort to evaluate the effects of such legislation upon our business. Our financial position or results of operations could be materially adversely impacted should we experience a material increase in claims costs or a change in healthcare legislation that impacts our business.

Our Expansion Into New Markets May Present Increased Risks Due To Our Unfamiliarity With Those Areas And Our Target Customers’ Unfamiliarity With Our Brands.

18

Consumers in any new markets we enter will not be familiar with our brands, and we will need to build brand awareness in those markets through significant investments in advertising and promotional activity. We may find it more difficult in new markets to secure desirable locations and to hire, motivate and keep qualified employees.

Issues Or Concerns Related To The Quality And Safety Of Our Products, Ingredients Or Packaging Could Cause A Product Recall And/Or Result In Harm To The Company’s Reputation, Negatively Impacting Our Results Of Operations.

In order to sell our products, we need to maintain a good reputation with our customers and consumers. Issues related to the quality and safety of our products, ingredients or packaging could jeopardize our Company’s image and reputation. Negative publicity related to these types of concerns, or related to product contamination or product tampering, whether valid or not, could decrease demand for our products or cause production and delivery disruptions. We may need to recall products if any of our products become unfit for consumption. In addition, we could potentially be subject to litigation or government actions, which could result in payments of fines or damages. Costs associated with these potential actions could negatively affect our results of operations.